Decentralized Finance

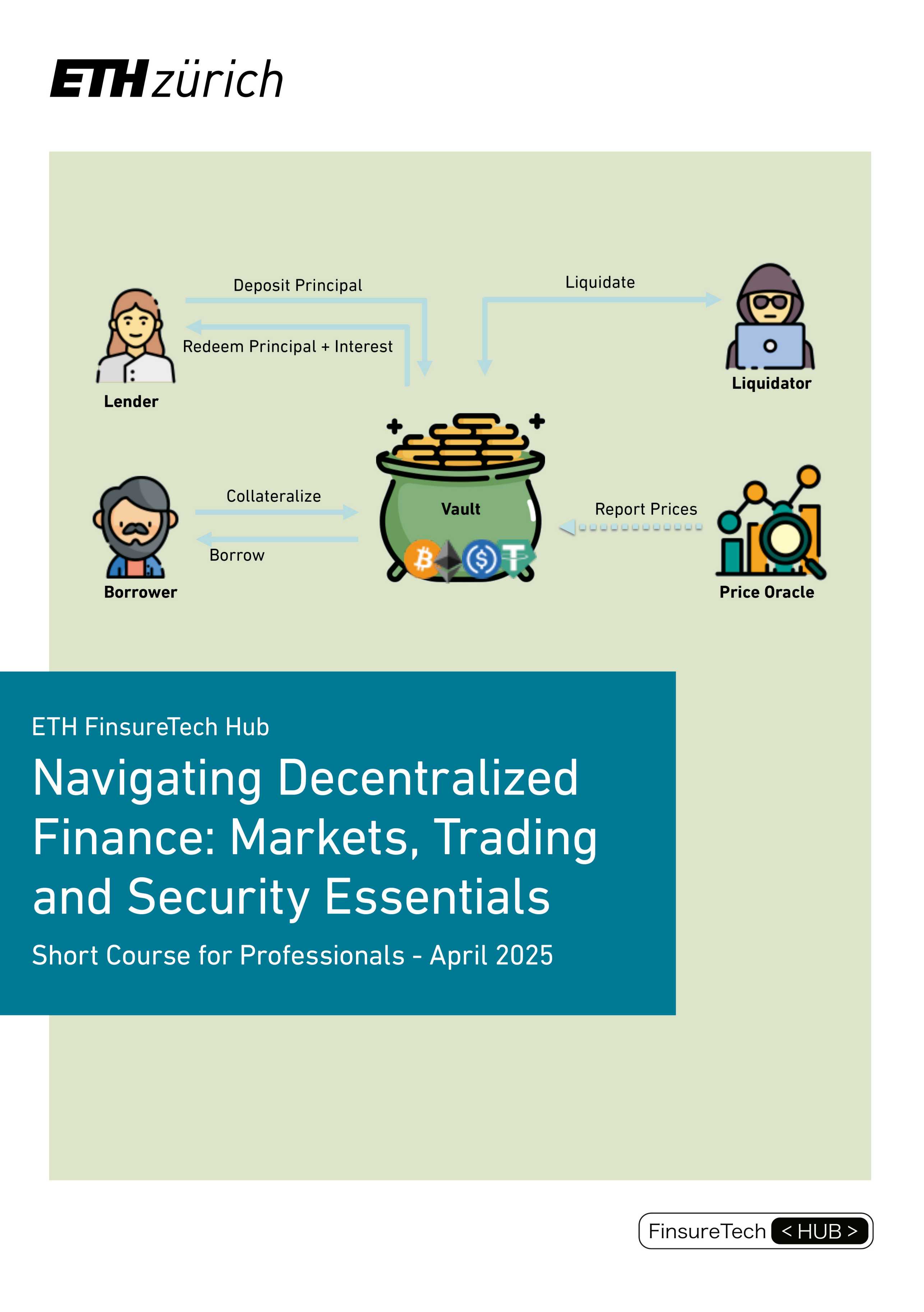

Decentralized Finance (DeFi) typically uses blockchain technology to create open, transparent, and accessible financial systems without intermediaries. It allows lending, borrowing, trading, and earning interest through smart contracts on various platforms accessible 24/7.

About

This course for professionals provides a comprehensive overview of decentralized finance (DeFi), with a focus on market, trading and security essentials for investors and users. Through practical insights and hands-on case studies, participants will learn to assess the origins of crypto funds, analyze fund security, and recognize vulnerabilities that may expose assets to attacks.

The course covers safe web services and tools, highlights prevalent cyber threats such as phishing and token inflation, and provides strategies to identify and avoid common pitfalls, including high APR advertisements and unverified token swaps.

By understanding the nuances of risk in DeFi, participants will gain the skills to manage investments responsibly, make informed decisions when trading or lending, and utilize block explorers and other tools without compromising asset safety. The program also offers techniques for optimal trading and lending/borrowing within decentralized platforms, equipping participants with the critical skills to navigate the dynamic DeFi landscape securely and effectively.

Coordination:

- Prof. Arthur Gervais, University College London & FinsureTech Hub

- Bastian Bergmann, FinsureTech Hub

Location: ETH Zurich Main Campus

Fee & Registration:

- 1500 CHF, incl. Coffee Breaks (1200 CHF for ETH Alumni)

- Register external page here (Link), 30 places available

Certification: Upon completion of a short exercise, participants obtain a certification from ETH Zurich for the completion of the course.

Programme

Session 1: Blockchain Basics, Mining, Smart Contracts

Date: Wed 2-Apr-2025, 9.15am - 1pm, ETH Zurich

This foundational session introduces participants to the core concepts of blockchain technology, exploring the mechanics of mining and consensus mechanisms. Students will gain hands-on experience with smart contracts, understanding their role as the backbone of decentralized applications and their practical implementation.

Session 2: DeFi Primitives and Compliance: DEXes, Lending and Stablecoins

Date: Thu 3-Apr-2025, 9.15am - 1pm, ETH Zurich

The session examines the fundamental building blocks of decentralized finance, focusing on decentralized exchanges, lending protocols, and stablecoins. Participants will learn how these systems operate while exploring crucial compliance considerations, including the implementation of regulatory requirements in decentralized systems and the evolving landscape of stablecoin regulation.

Session 3: Miner Extractable Value: Market Manipulations, Attacks or Arbitrage

Date: Wed 16-Apr-2025, 9.15am - 1pm, ETH Zurich

This session delves into the complex world of Miner Extractable Value (MEV), examining the fine line between legitimate arbitrage opportunities and potentially harmful market manipulations. Participants will analyze real-world cases to understand the technical mechanisms behind MEV extraction and its implications for market fairness and efficiency.

Session 4: Blockchain Tracing and Anti-Tracing across Bitcoin, Ethereum and Layer 2

Date: Thu, 17-April-2025, 9.15am - 1pm, ETH Zurich

In this comprehensive session, participants will explore transaction tracing methodologies across different blockchain platforms and scaling solutions. The workshop covers advanced techniques for tracking fund flows through Layer 2 networks while examining various privacy-preserving mechanisms and anti-tracing strategies employed across these systems.

Hands-on Sessions & Blockchain Workbench:

Collaborate with peers in hands-on case work sessions during the workshops designed to foster understanding and innovative thinking. participants will get access to a specifically designed Blockchain Workbench to test and experiment in a safe envrionment.